Understanding Dunning Management: Your Revenue Safety Net

Imagine your subscription business is a smoothly flowing river. Customers are happily sailing downstream, enjoying the journey (and your product). But what happens when a fallen tree blocks their path? That’s where dunning management comes in, acting like a helpful park ranger to clear the way.

Dunning management isn’t about strong-arm tactics; it’s about guiding customers towards uninterrupted service. It tackles involuntary churn, those frustrating moments when a customer wants to stay but a payment fails.

Think expired credit cards, changed bank details, or simply insufficient funds. These little snags can create a significant leak in your revenue stream. In fact, some businesses see up to 50% of their total churn attributed to these preventable payment issues.

Why Dunning Management Matters

Many customers won’t update their payment info on their own, even with the best intentions. Life gets in the way – forgetfulness, procrastination, the general hassle of updating details online.

Dunning management gently nudges these customers towards a successful payment, preserving the customer relationship and your revenue. It’s a proactive approach, not a reactive one.

The Impact on Your Bottom Line

Effective dunning is crucial for healthy cash flow and reducing bad debt. It stops accounts receivable from becoming write-offs, a vital aspect of any company’s financial well-being. Even in traditional sectors like utilities, the value of dunning has grown significantly, seeing a 20% increase in recent years. Learn more about dunning management in SaaS here.

Automating Dunning With Stunning

Integrating a smart dunning solution like Stunning automates the entire process. Think personalized, timely communication without lifting a finger. This frees you to focus on growth while Stunning minimizes churn and maximizes revenue recovery.

This proactive approach transforms potential losses into recovered revenue and strengthens customer relationships. It’s about building a system that works for everyone, ensuring a smooth and positive experience for both you and your customers.

The Real Mathematics Of Failed Payments

Let’s be honest: failed payments are more than just a nuisance. They can be a major roadblock to growth for your subscription business. Imagine constantly filling a bathtub with a running faucet, only to realize the drain is open. That’s what it’s like focusing on acquiring new customers while neglecting dunning management.

For a deeper dive into the relationship between dunning and revenue, check out this helpful article: Making Money. It really highlights how crucial effective dunning is for a healthy bottom line.

The Impact of Involuntary Churn

Some businesses see a shocking 50% of their total churn caused by payment problems alone. This involuntary churn, where customers fully intend to pay but simply can’t, is a significant revenue drain. It’s like losing loyal fans because of a ticketing glitch, not because they’re unhappy with the show. These customers are your most likely recovery targets, so losing them is a huge missed opportunity.

Why Don’t Customers Update Their Payment Information?

Why the reluctance to update payment details? Often, it’s just life. People are busy, and updating card information feels like a chore – easily forgotten in the hustle of everyday life.

This is where smart dunning management steps in. It bridges the gap between a customer’s intention to pay and a successful transaction by providing gentle reminders and convenient update options. A well-designed dunning strategy works with human nature, not against it.

How Industries Are Affected

The fallout from failed payments varies across different business models. A SaaS platform might have fewer failed payments compared to a meal kit delivery service, but the long-term revenue impact can be equally substantial.

Imagine a SaaS company charging $50 per month. Losing just 5% of customers each month to failed payments adds up significantly over time. What seems like a small percentage can quickly become a substantial leak if left unchecked. This highlights the importance of dunning management for all subscription businesses, no matter the industry.

To illustrate the varying impacts, let’s take a look at this comparison:

The True Cost of Payment Failures Across Industries: A comprehensive breakdown showing average churn rates, revenue impact, and recovery potential across different subscription business models.

| Industry | Average Involuntary Churn % | Revenue Impact | Recovery Potential | Typical Recovery Time |

|---|---|---|---|---|

| SaaS | 5% | Medium – impacts recurring revenue | High – customers often intend to continue service | 1-2 billing cycles |

| Subscription Boxes | 10% | High – immediate loss of product and shipping costs | Medium – depends on customer satisfaction and product value | 2-3 billing cycles |

| Streaming Services | 3% | Low – smaller individual transaction value | High – customers are often engaged with content | 1 billing cycle |

| Online Membership Sites | 7% | Medium – impacts recurring revenue access | Medium – depends on content exclusivity and perceived value | 1-2 billing cycles |

As you can see, even small percentages of involuntary churn can add up to real losses across different industries. The faster you recover failed payments, the lower the overall revenue impact.

This table demonstrates why a proactive approach to dunning management is vital, no matter your specific niche. Understanding your industry’s typical churn rates and recovery potential can help you fine-tune your dunning strategy and plug those revenue leaks effectively.

Building Your Proactive Recovery Strategy

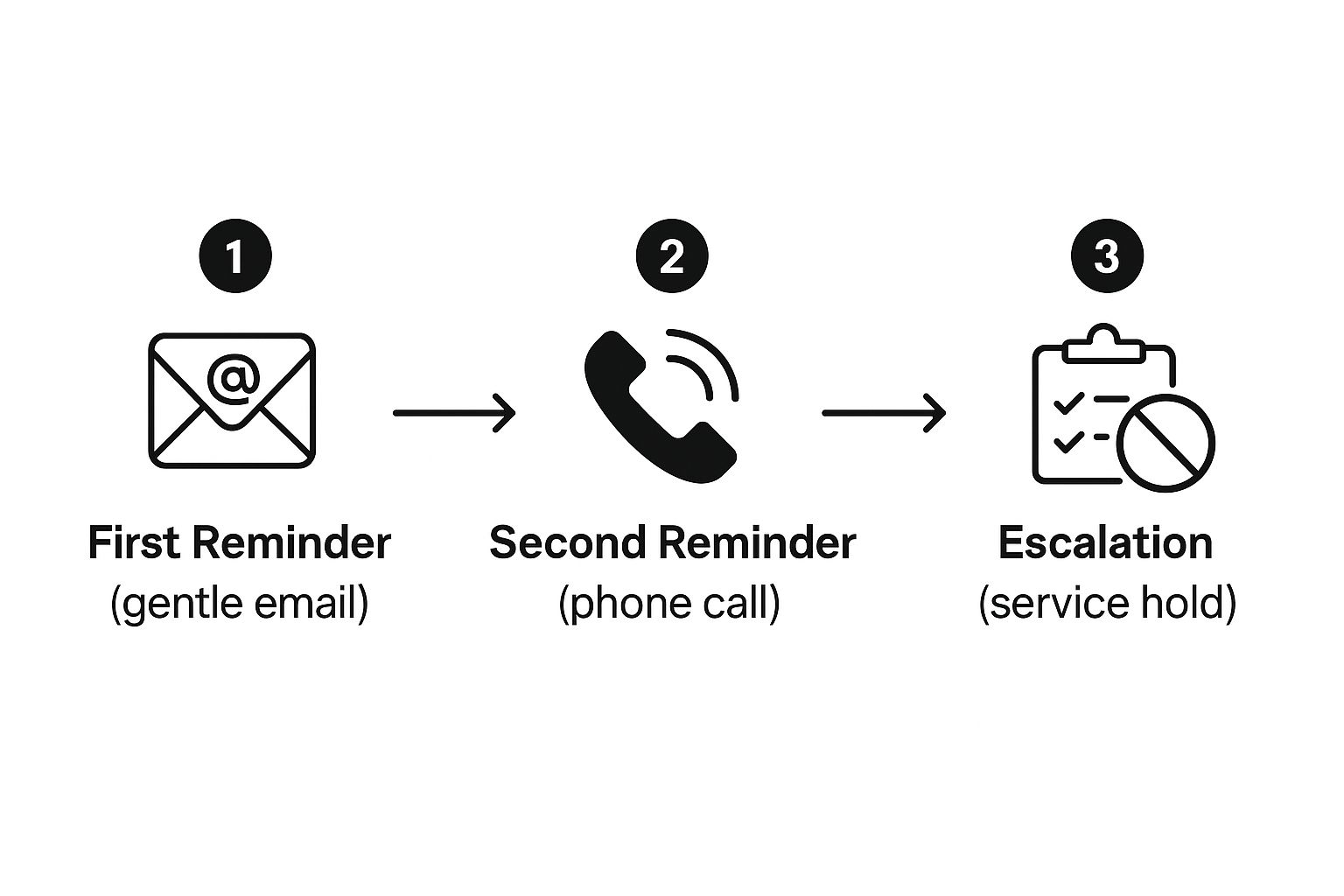

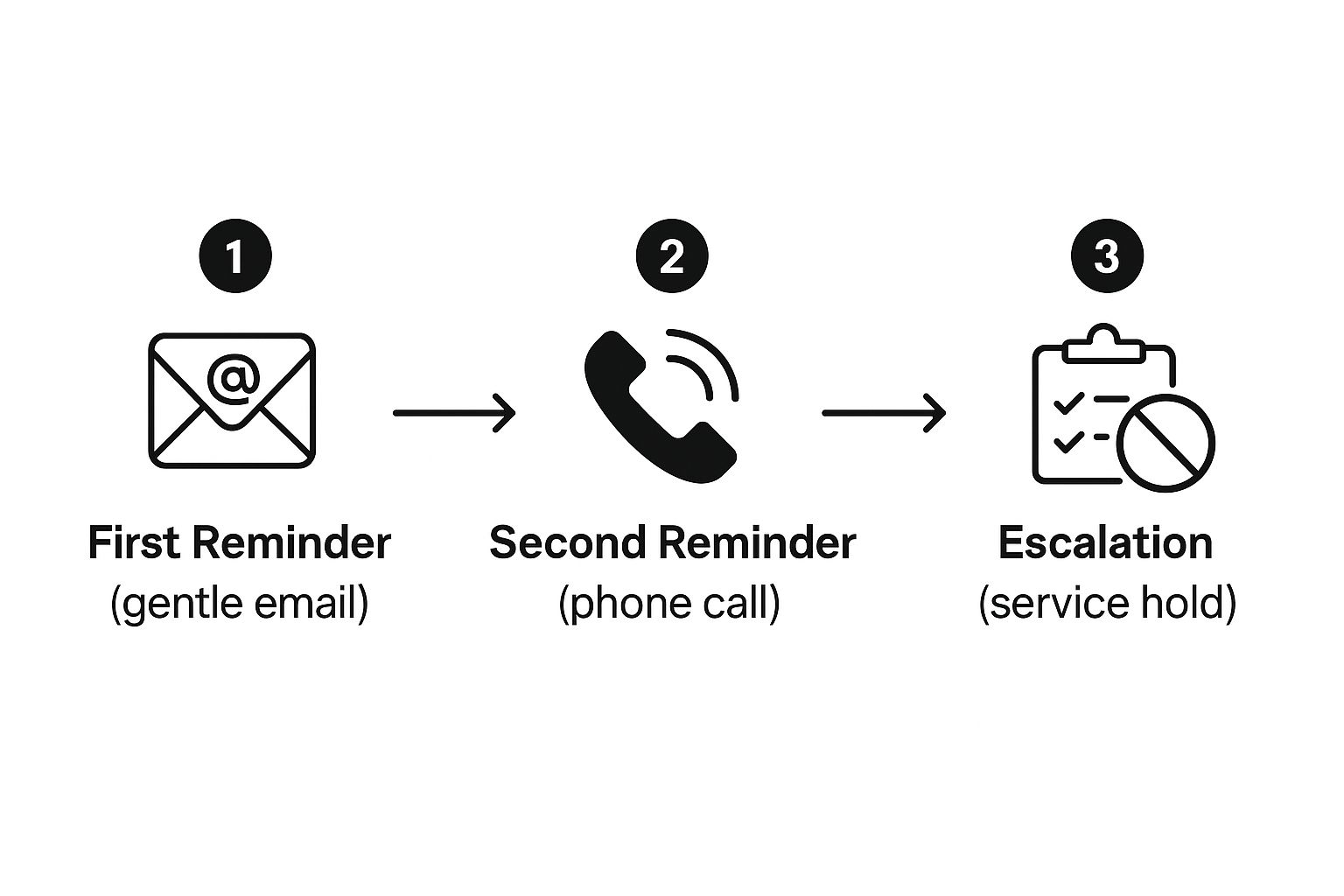

Most businesses think of dunning management as a fire drill – reacting to failed payments after they happen. But forward-thinking companies build proactive systems that prevent these issues and even use them as opportunities to strengthen customer relationships. Think of it like preventative maintenance on your car – it’s much better to address small issues before they become major problems. This infographic illustrates a simplified dunning process:

As this visualization shows, a tiered approach works best. Starting with gentle reminders and gradually escalating to more direct actions recovers payments effectively while keeping customers happy.

Crafting Your Communication Strategy

Effective dunning management begins with understanding why a payment failed. Is it a hard decline (like insufficient funds) or a soft decline (like an expired card)? Knowing the difference lets you tailor your response. Imagine getting a call from the bank about an overdraft – it’s a very different situation than a misfiled credit card number.

Next, design recovery sequences that feel helpful, not like nagging emails. Your communication should reflect your brand. A playful subscription box company might use humor in its initial reminders, while a B2B SaaS platform like Salesforce would keep a more professional tone. To simplify your payment recovery, consider automated invoicing tools like email payment request services.

Timing matters too. Retry attempts should be strategic. Think about retrying during business hours when funds are more likely available. Treating customers differently based on their payment history and value is also crucial. Your loyal, high-value customers deserve VIP service.

Automating for Personalization

This screenshot from Recurly shows a clear dunning management interface. Visualizing your process and tracking key metrics is essential for continuous improvement. Automation is helpful, but don’t let it feel robotic. Tools like Stunning let you personalize automated messages based on customer data, making them feel more relevant.

The Art of Escalation

Finally, know when to bring in your human team and how to preserve customer relationships even when recovering payments gets tough. Sometimes, a personal phone call can solve a problem an email can’t. Even with automated systems, the human touch is powerful. It adds a layer of understanding that considers individual circumstances. By creating a proactive, customer-focused dunning management strategy, you’ll recover more revenue and build stronger customer relationships. This shifts dunning from a reactive cost center to a proactive engine for growth.

Measuring What Actually Drives Business Results

It’s tempting to get lost in the weeds when analyzing dunning management. We can easily fixate on surface-level numbers, but real success comes from understanding the metrics that truly move the needle for your revenue and customer relationships. Think of it like checking your website traffic – lots of visits are great, but are they converting into sales? That’s what we need to uncover with dunning.

Beyond Simple Recovery Rates

Recovering failed payments is obviously important, but just looking at the percentage of payments recovered doesn’t give you the full picture. Imagine recovering a $5 payment from a customer who’s about to cancel their subscription. Now compare that to recovering a $50 payment from a loyal, long-term subscriber. See the difference?

This is where understanding customer lifetime value becomes essential. Your dunning strategies should prioritize keeping those high-value customers happy, even if it means a slightly lower overall recovery rate in the short term. It’s about playing the long game.

Relationship Preservation: The Unsung Hero

Effective dunning management isn’t just about clawing back lost dollars; it’s about nurturing customer relationships. A negative dunning experience can alienate customers, even if they fully intended to pay. Think about a time you had a frustrating experience with a company’s customer service. Did you want to continue doing business with them? Probably not.

That’s why measuring customer satisfaction and retention rates after the dunning process is so crucial. It tells you if your approach is building loyalty or driving customers away.

Benchmarking for Better Performance

How do you know if your dunning efforts are actually good? Benchmarking helps answer that question. By comparing your performance to similar companies, you can spot areas for improvement and see what top performers are doing differently. Services like Recurly offer integrated dunning benchmarks that let you compare your recovery, churn, and efficiency against industry peers. You can learn more about Recurly’s benchmarks here.

This type of analysis helps you understand where you stand and identify potential opportunities to optimize your strategy. Think of it as a friendly competition – it helps you identify your strengths and weaknesses so you can level up your game.

Communicating Value to Stakeholders

When presenting dunning performance to stakeholders, focus on the bottom line. Don’t just report recovery rates; show how your efforts are impacting the overall health of the business. For example, illustrate how reduced churn due to effective dunning translates into higher revenue and increased customer lifetime value. Speak their language – the language of business impact.

Predictive Metrics and Cohort Analysis

Finally, use cohort analysis and predictive metrics to uncover hidden patterns and fine-tune your approach. Analyzing how different customer segments react to various dunning strategies can unlock powerful insights. Imagine you discover that a certain type of reminder email works wonders for one group of customers but falls flat with another. That’s gold!

This data-driven approach allows for constant improvement. You can tailor your dunning process to maximize both short-term recovery and long-term customer retention. It’s a virtuous cycle – the more you understand, the more effective your dunning management becomes.

Smart Automation That Feels Human

Running a subscription business presents a unique challenge: you need the efficiency of automated dunning management, while also maintaining the personal touch crucial for building strong customer relationships. It’s a balancing act, but thankfully, you don’t have to choose one over the other. Savvy businesses are using technology to deliver personalized dunning experiences at scale.

Balancing Automation with Personalization

Effective dunning is all about finding the sweet spot between automation and personalization. Too much automation, and your communications become impersonal, like a robot sending out form letters. Too little, and you and your team are bogged down in manual tasks, chasing payments.

Think of it like email marketing. You likely use automated sequences for your initial outreach, but for your most valued clients, you probably add a personal touch with individual follow-ups. Dunning follows the same principle. Automated emails and SMS can handle the bulk of payment reminders, but sometimes a personal touch is what it takes to make a real difference.

Let’s say a loyal subscriber with a flawless payment history suddenly has a failed payment. An automated system will certainly flag it. But a human might notice the pattern of on-time payments and realize it’s likely a simple issue like an expired card. A quick phone call or personalized email can often resolve the problem immediately and even strengthen the customer relationship.

Data-Driven Personalization

Generic, one-size-fits-all dunning messages are often ignored; they feel like spam. Using customer data effectively allows you to tailor your communication, making it much more impactful. Addressing customers by name, referencing their subscription history, and offering personalized solutions shows that you value their business.

This is where dunning management tools like Stunning truly shine. Stunning integrates with your billing platform (like Stripe), giving you the power to segment customers and personalize automated messages based on their specific data. The result? A more relevant and engaging experience for your subscribers.

Avoiding the Over-Automation Trap

While automation is a cornerstone of efficient dunning management, be careful not to over-automate. Bombarding customers with impersonal payment reminders without considering their individual situations can actually drive them away.

Imagine a customer experiencing financial difficulties. Receiving a flood of impersonal emails demanding payment only adds to their stress and can damage your relationship with them. A more empathetic approach, such as offering a temporary pause or a flexible payment plan, could preserve the customer and their lifetime value in the long term.

The Power of Human Intervention

Knowing when to bring in your team is critical. Stunning automates much of the dunning process, but it also provides the tools to identify those moments when a human touch is needed. This might involve a personal phone call, a customized email, or a proactive offer of support.

These interventions are particularly valuable for maintaining relationships with high-value customers. They demonstrate care and understanding, transforming a potentially negative experience into a positive one. This builds loyalty and reinforces the value of your service. By combining the efficiency of automation with the power of human interaction, you create a dunning management system that not only recovers revenue, but also strengthens customer relationships. It’s not simply about collecting payments; it’s about building a sustainable business grounded in trust and long-term customer value.

Advanced Strategies That Separate Leaders From Followers

This screenshot from Stripe‘s documentation gives you a glimpse into the intricate world of subscription management. There are a lot of components involved in a subscription’s lifecycle, and dunning plays a vital role in keeping that revenue flowing smoothly. Managing this complexity effectively calls for a robust dunning strategy.

Now that we understand the basics of dunning management, let’s dive into the advanced strategies that truly set the best apart. These tactics shift revenue recovery from a reactive band-aid to a proactive engine for growth. It’s like moving from playing checkers to chess.

Segmentation: Treating Your Best Customers Like Royalty

Basic dunning often uses a one-size-fits-all approach. But that’s not always the most effective way to go about it. Advanced dunning management understands that each customer is unique. By segmenting your customers based on things like their lifetime value, payment history, and engagement levels, you can customize your dunning communication for maximum impact.

Think of it this way: a high-value customer who always pays on time deserves the royal treatment. A simple, friendly reminder might be all they need. On the other hand, a customer with multiple failed payments might require a more proactive approach. Perhaps offering alternative payment methods or suggesting a temporary subscription pause. This targeted approach keeps your most valuable subscribers happy while maximizing your overall recovery efforts.

Multi-Channel Communication: Reaching Customers Where They Are

Email is a standard for dunning, but relying solely on it can limit your reach. Advanced dunning programs take a multi-channel approach. This means using SMS, in-app notifications, or even targeted direct mail to connect with customers where they’re most likely to see it. This increases the chance of a successful recovery and creates a more engaging experience for your customers.

Let’s say a customer keeps ignoring your dunning emails. A well-timed text message or a subtle in-app notification could be the reminder they need to update their payment info. This multi-channel approach isn’t just about better recovery rates; it’s about providing proactive customer service.

Timing Optimization: The Science of the “When”

When you send your dunning communication is just as important as what you say. Sending reminders at the right time can significantly boost your recovery rates. Imagine sending a payment reminder at 3 a.m. – not very effective, right? Sending it during business hours, when people are more likely to access their finances, makes a world of difference.

Advanced dunning solutions, like Stunning, use intelligent timing optimization. They leverage data and machine learning to figure out the best time to contact each customer. This personalized approach maximizes your chances of getting paid while respecting your customer’s time. It’s like delivering a package when you know someone’s home to receive it.

Beyond the Basics: Innovative Recovery Strategies

Top companies are taking dunning to the next level with strategies that focus on building customer relationships and fostering growth. These tactics go beyond simple payment reminders, offering flexible options that meet each customer’s unique needs:

- Intelligent Grace Periods: Offering a short grace period for unintentional late payments shows goodwill and prevents unnecessary churn.

- Flexible Payment Plans: Giving customers the option of installment payments or a temporary subscription downgrade can help them stay subscribed even when facing financial challenges.

- Loyalty-Based Recovery: Rewarding loyal customers with extended payment deadlines or exclusive discounts encourages on-time payments and strengthens relationships.

These strategies demonstrate a commitment to customer success and set your business apart. They transform dunning from a purely transactional process into a chance to build loyalty and increase customer lifetime value. By using these advanced strategies, you can turn your dunning program into a sophisticated revenue recovery engine that strengthens customer relationships and fuels sustainable growth.

Your Implementation Roadmap To Dunning Excellence

Knowledge without action doesn’t get you very far. This section translates everything we’ve covered into a practical, step-by-step plan you can use right away, regardless of your current dunning setup. We’ll guide you through a prioritized roadmap, focusing on high-impact changes first, from quick wins this week to long-term improvements that build over time.

Auditing Your Current Dunning Process: Finding the Gaps

Before changing anything, you need to understand where you are now. It’s like a doctor diagnosing a patient before prescribing treatment. A dunning audit helps identify the strengths and weaknesses of your current process. Use this checklist as your guide:

- Payment Gateway Integration: How smoothly does your system connect with your payment gateway? Are failed payments flagged quickly?

- Communication Strategy: What messages are customers receiving when payments fail? Are they personalized, helpful, and consistent with your brand?

- Retry Logic: How often are you retrying failed payments? Are your retries optimized based on the reason for the decline?

- Escalation Process: When do you bring in a human touch? Are high-value customers handled differently?

- Metrics Tracking: What data are you tracking? Are you measuring things like recovery rates, customer retention, and the overall impact on your business?

By honestly assessing your current approach, you can pinpoint the best areas for improvement and customize your implementation plan.

Building Buy-In: Getting Your Team On Board

Effective dunning management involves the whole team. Getting key stakeholders on board, especially your customer support and finance teams, is essential for success. Clearly communicate the advantages of a better dunning process:

- Reduced Churn: Show how better dunning minimizes involuntary churn and boosts customer lifetime value.

- Increased Revenue: Explain how recovering more failed payments directly improves your bottom line.

- Improved Customer Relationships: Highlight how a customer-focused approach to dunning can actually strengthen relationships and build loyalty.

- Streamlined Workflows: Emphasize how automation gives your team more time to focus on more strategic tasks.

By presenting a clear argument for change, supported by data and a well-defined plan, you’ll gain the support you need.

Creating a 90-Day Action Plan: From Quick Wins to Long-Term Gains

This 90-day plan outlines a phased approach, letting you address the most critical parts of dunning management step-by-step:

- Phase 1: Quick Wins (Weeks 1-4): Concentrate on simple improvements, like optimizing email templates, implementing basic customer segmentation, and adjusting your retry logic.

- Phase 2: Building Momentum (Weeks 5-8): Integrate a dunning management tool like Stunning, explore different communication channels (email, SMS, etc.), and refine your escalation process.

- Phase 3: Continuous Optimization (Weeks 9-12): Implement more advanced segmentation, explore predictive analytics, and consistently monitor and refine your dunning performance.

This structured plan ensures steady progress and lets you adapt based on real data and feedback.

Overcoming Common Implementation Challenges

Change isn’t always easy. Anticipating potential roadblocks can help you overcome them:

- Technical Integration Hurdles: Make sure integrating with your payment gateway goes smoothly by following the documentation and using available support.

- Team Resistance: Address any concerns upfront through clear communication, training, and by showing the advantages of the new system.

- Data Limitations: Start with the data you have, even if it’s incomplete. You can gradually refine your strategy as you collect more data.

By tackling these challenges directly, you’ll set yourself up for a smoother, more successful implementation.

Transform your dunning from a chore into a growth engine. Start your free trial with Stunning today and see the difference.