Understanding Payment Orchestration Platforms: The Conductor’s Role

Imagine a busy restaurant kitchen. Multiple chefs are working at once, each with their own recipes and timings. But every dish needs to go out perfectly and on time. Managing lots of different payment methods without orchestration feels a lot like that chaotic kitchen. Payment orchestration platforms are like the head chef, coordinating all the different payment processors, methods, and rules to create smooth, seamless transactions.

This coordination is essential because there are so many ways to pay these days. The image below, from Wikipedia’s page on payment systems, shows just how many options there are, from credit and debit cards to mobile payments and more. It really highlights the challenge businesses face in managing all these different methods efficiently.

The main takeaway here is the sheer variety and interconnectedness of the payment world. Navigating it successfully requires a system that can handle the specifics of each method. That’s exactly where payment orchestration comes in.

Why Orchestration Matters

For businesses, trying to manage multiple payment gateways and processors can quickly become a huge headache. Each processor has its own set of rules, fees, and ways you need to integrate with it. This complexity means more work, higher costs, and potential security risks. That’s why so many businesses are turning to payment orchestration platforms. In fact, the market for these platforms reached a value of about USD 1.41 billion to USD 1.56 billion in 2024, showing the growing need for smoother payment processing. Learn more about this growing market.

The Benefits of a Unified Approach

Payment orchestration platforms take away this complexity by giving businesses one central place to manage all their payment activity. This unified approach has several key benefits:

- Improved Conversion Rates: Offering customers their preferred way to pay and optimizing the checkout process can dramatically reduce abandoned carts and increase sales.

- Reduced Processing Costs: Smart routing automatically chooses the cheapest payment processor for each transaction, keeping fees down and profit margins up.

- Enhanced Security: Orchestration platforms often have strong fraud prevention tools and security measures to protect both businesses and their customers.

- Simplified Operations: By centralizing payment management, businesses can automate tasks, simplify reconciliation, and get more control over their payment flows.

This move from scattered payment processing to a unified, orchestrated system is changing the way businesses handle payments. It’s not just about taking payments; it’s about managing them strategically to grow the business and create a better experience for customers. This sets the stage for understanding how these platforms actually work behind the scenes, which we’ll look at next.

How Payment Orchestration Platforms Actually Work Behind The Scenes

Think of a payment orchestration platform like a smart GPS for your online transactions. Instead of mapping roads, it navigates the complex world of payment processors, finding the optimal route for each payment. It considers factors like cost, speed, and success rates, making these decisions in milliseconds.

Imagine this: a customer in London is buying a book from a website based in New York. The payment orchestration platform instantly assesses the best way to process the transaction, considering the customer’s card type, currency, the processor’s performance history, and even potential fraud risks.

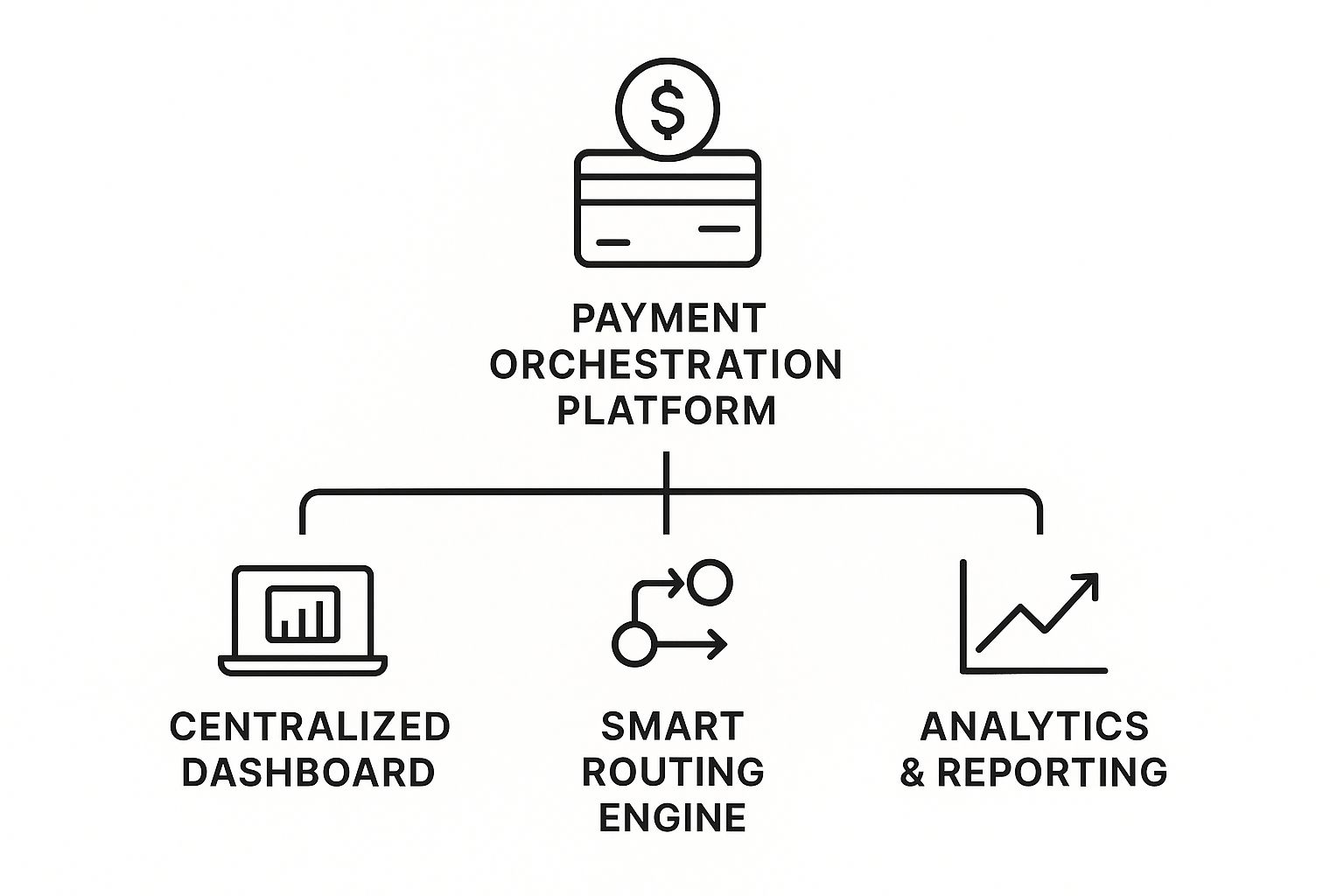

This infographic provides a visual overview of a typical platform. The centralized dashboard provides a single point of control, the routing engine makes smart decisions about where to send payments, and the analytics tools help businesses track performance.

Smart Routing: The Brains of the Operation

At the heart of any payment orchestration platform lies the smart routing algorithm. This is the engine that drives the entire system. It’s constantly evaluating multiple factors to determine the best payment pathway.

- Card Type and Currency: Certain processors excel at handling specific card types or currencies. The algorithm takes this into account to maximize acceptance rates.

- Processor Availability: If a processor is experiencing downtime, the algorithm automatically reroutes the transaction.

- Fraud Scores: Suspicious transactions can be flagged and routed through processors specializing in fraud detection.

Choosing the right processor for every single transaction is a complex task. Payment orchestration platforms automate this decision-making process.

Cascade Logic and Failover Mechanisms: Ensuring Payment Success

Think about what happens if the initially selected processor is temporarily unavailable. That’s where cascade logic and failover mechanisms come in. These features automatically reroute the transaction through a backup processor, ensuring that the payment doesn’t fail due to a temporary hiccup.

Let’s say a customer’s payment is initially routed to Processor A. If Processor A is down, the platform instantly reroutes the transaction to Processor B. This redundancy maximizes the chances of a successful payment.

Real-Time Performance Monitoring: Keeping Your Finger on the Pulse

Payment orchestration platforms provide real-time visibility into transaction performance. This allows businesses to:

- Identify bottlenecks

- Monitor processor performance

- Pinpoint areas for optimization

This data is invaluable for improving payment strategies. By understanding how each processor is performing, businesses can adjust routing rules and fine-tune their payment flow.

To understand the key components involved, let’s take a look at the following table:

Payment Orchestration Platform Architecture Components

| Component | Function | Business Impact |

|---|---|---|

| Routing Engine | Determines the optimal payment gateway for each transaction. | Increased authorization rates, reduced costs, improved processing speed. |

| Payment Gateway API | Connects to various payment processors. | Flexibility to support different payment methods and geographies. |

| Data Analytics Engine | Tracks and analyzes payment data in real-time. | Insights into payment performance, fraud detection, and optimization. |

| Reporting Dashboard | Provides a visual overview of payment performance and key metrics. | Easy monitoring and identification of trends. |

| Security Module | Ensures secure payment processing and protects against fraud. | Reduced risk of fraud and data breaches. |

This table summarizes the core components of a payment orchestration platform and their respective functions, highlighting the benefits they bring to a business. Each component plays a vital role in ensuring smooth, efficient, and secure payment processing.

Essential Features That Separate Leaders From Basic Solutions

Not all payment orchestration platforms are created equal. Choosing the right one can be the difference between healthy profits and significant losses. So, let’s explore the key features that set the best platforms apart from simple routing services.

Intelligent Retry Logic: More Than Just Second Chances

Think of basic retry logic like repeatedly knocking on a door without checking if anyone’s home. Intelligent retry logic, on the other hand, is like checking the windows first, maybe even peeking at the calendar to see if the homeowner is on vacation. It analyzes why a payment failed. Was it a technical glitch with the processor? Insufficient funds? Knowing the reason lets the system adjust its strategy, perhaps trying a different payment gateway or waiting a few days. This adaptable approach can drastically improve your successful payment rate. Imagine a payment fails due to insufficient funds. The system could cleverly retry the transaction later in the month, when the customer is more likely to have the money available.

Advanced Fraud Detection: Protecting Without Blocking

Effective fraud prevention is like being a good bouncer – you want to keep out the troublemakers without turning away paying customers. Top-tier payment orchestration platforms use smart algorithms and machine learning to analyze transactions in real-time, spotting subtle signs of fraud without adding friction for genuine buyers. This creates a secure environment without sacrificing a smooth customer experience.

Tokenization: Security and Seamlessness

Tokenization is like using a valet key. It grants access without handing over the master key to your car. It replaces sensitive payment details with unique, non-sensitive tokens. This protects customer data, simplifies PCI compliance, and makes checkout smoother. Think of it as a win-win-win: better security, less hassle, and happier customers.

Stripe is a great example of a platform offering strong tokenization. Their user-friendly design and developer tools make implementing advanced features like tokenization easier for businesses. If you’re using Stripe, you might find this helpful: Stripe Supercharged: 20+ Apps to Help Take Your Stripe App to the Next Level.

Analytics and Reporting: Uncovering Hidden Opportunities

In the world of payments, data is power. Leading platforms provide in-depth analytics that go beyond simple transaction counts. They give you insights into payment gateway performance, reasons for declines, and customer behavior. This allows you to optimize your payment strategies and find areas for improvement, ultimately leading to higher revenue and increased customer satisfaction. It’s not just about processing payments; it’s about learning from them.

To better understand the differences between core and more sophisticated offerings, take a look at the table below:

Essential vs. Advanced Features Comparison

Comparison of basic payment orchestration features versus advanced capabilities

| Feature Category | Essential Features | Advanced Features | Use Case |

|---|---|---|---|

| Retry Logic | Basic retries on failed transactions | Intelligent retries based on decline reason | Failed transaction due to insufficient funds is retried a few days later |

| Fraud Detection | Basic fraud rules | Machine learning-based fraud scoring | Real-time fraud detection minimizes false positives |

| Security | Basic encryption | Tokenization of sensitive data | Securely storing customer payment information |

| Analytics | Basic transaction reporting | In-depth analytics on payment performance | Identifying trends in decline rates and optimizing payment routing |

This table highlights how advanced features can unlock greater control and optimization within your payment flow.

Choosing the Right Platform: A Strategic Investment

Choosing a payment orchestration platform is a big decision, one that will impact your business for years to come. By understanding the key features that distinguish the best from the rest, you can make a smart choice that boosts revenue, improves security, and sets your business up for success. It’s an investment in your future.

Real-World Success Stories: Where Orchestration Delivers Results

The real magic of payment orchestration platforms isn’t about the tech itself, it’s about how it tackles everyday business problems. Let’s explore how companies are using these platforms to see real, positive changes.

Reducing Cart Abandonment: Smarter Routing in Action

Picture an online store struggling with a lot of abandoned shopping carts. They find out that many international shoppers give up because they don’t see their preferred payment options. By using a payment orchestration platform and something called smart routing, they can offer local payment choices to everyone. The result? A 23% drop in cart abandonment. This isn’t just a tech upgrade; it’s money straight back into their pockets.

Combating Involuntary Churn: Intelligent Retries

Businesses with subscriptions often face involuntary churn – losing customers because payments fail. But an intelligent retry strategy can make a big difference. Imagine a customer’s card expires. Instead of canceling their subscription, the platform automatically retries the payment with an updated card or asks the customer to update their info. This can cut involuntary churn in half! It keeps customers happy and builds loyalty.

Simplifying Complex Payments: The Marketplace Advantage

Online marketplaces often struggle with splitting payments to different vendors. Payment orchestration smooths out this process, making sure each vendor gets paid the right amount while following all the rules. This boost in efficiency streamlines operations and builds trust with vendors, allowing for faster growth without extra admin work. The marketplace itself can deal with different kinds of transactions – business-to-consumer (B2C), business-to-business (B2B), and consumer-to-consumer (C2C) – and work in areas like e-commerce, travel, and healthcare. E-commerce is a big part of this, thanks to the rise of online shopping and the demand for easy payments. Discover more insights about the market.

Case Studies: Orchestration in Diverse Industries

Let’s look at some specific examples:

- Travel Platform: Imagine a travel platform booking trips in multiple currencies across 40 countries. They use orchestration to smartly send payments to local processors, saving money and boosting success rates.

- Gaming Company: Think of a gaming company handling millions of small transactions every day. They depend on orchestration for fast processing and fraud protection, keeping players happy.

- B2B Software Provider: A software company with strict security needs uses tokenization and advanced fraud detection within their orchestration platform to keep sensitive payment data safe.

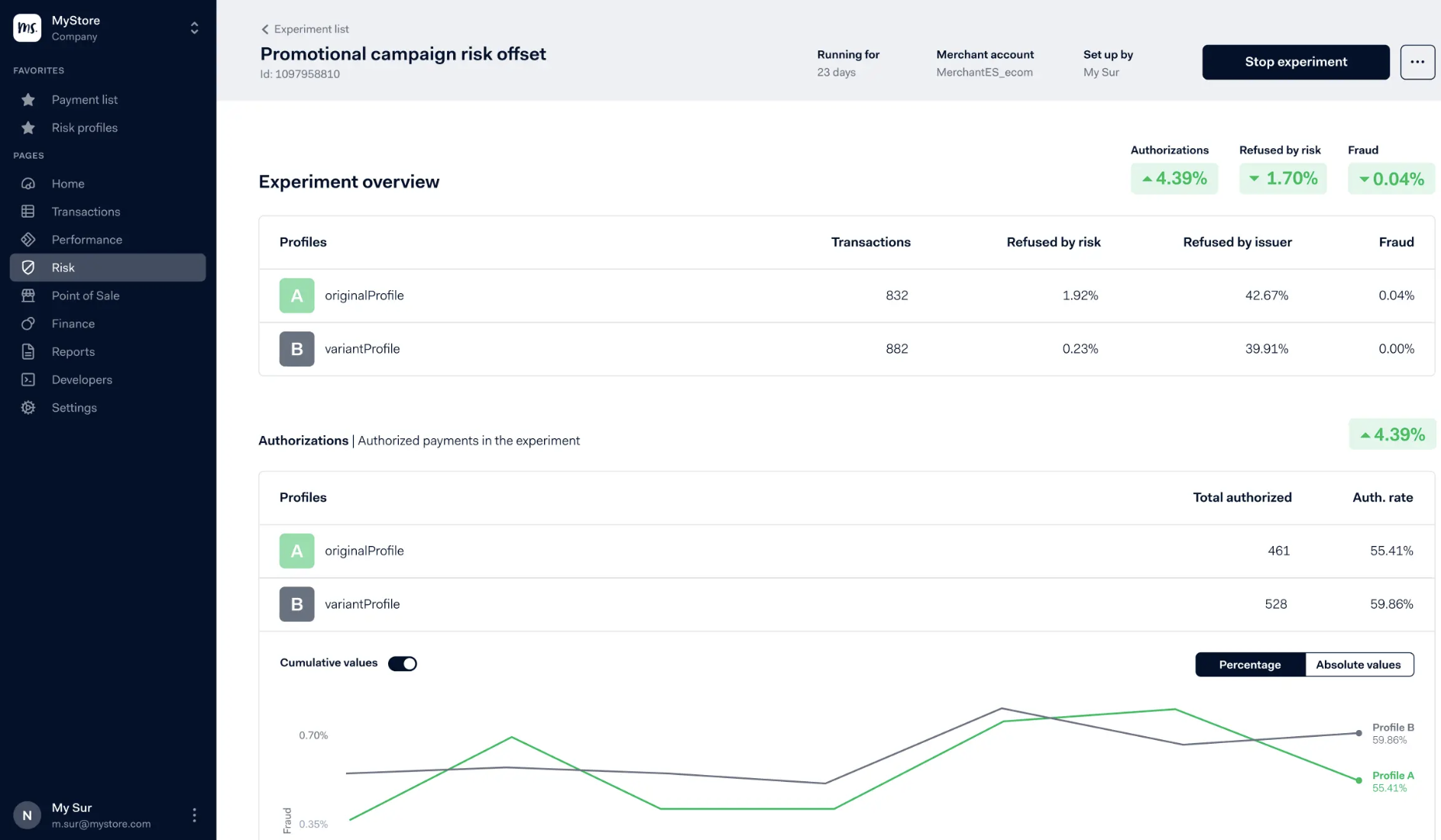

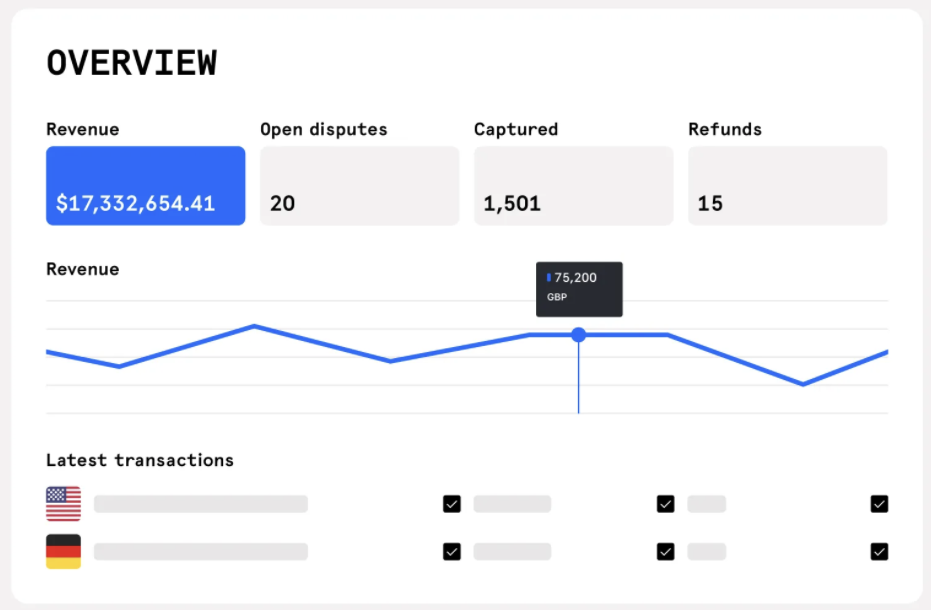

The screenshot below from Adyen shows a typical dashboard for a payment orchestration platform. It gives a clear view of important numbers, making it easy to track and manage payments.

The clean design and easy-to-read charts show how important user-friendly tools are for managing payments effectively. Real-time data and clear performance info help spot problems and find ways to improve things quickly.

Lessons Learned: From Mistakes to Mastery

These examples show the real impact of payment orchestration. They also teach us valuable lessons. Many companies struggle at first with choosing the right platform or setting it up properly. Some don’t test things thoroughly or move their data carefully, which causes early problems. Others don’t realize how important it is to keep improving things. Learn more about recovering failed payments by reading: Lessons Learned From Recovering Over $85 Million in Failed Payments for Stripe Customers. Learning from these mistakes helps businesses have a smoother experience and see faster results. These real-world examples prove how payment orchestration creates real advantages that lead to better business outcomes.

Strategic Implementation: Your Roadmap To Payment Orchestration

Moving from a scattered payment system to a well-organized, orchestrated one takes careful planning and execution. Think of it like renovating a house – you wouldn’t just start knocking down walls without blueprints. Similarly, choosing a payment orchestration platform is just one piece of a larger strategy that needs to fit your business goals. This section walks you through the key steps, from the initial evaluation to continuous improvement, using real-world examples and lessons learned from successful implementations.

Assessing Your Current Landscape: Knowing Where You Stand

Before exploring payment orchestration platforms, take a look at your current payment system. Imagine a plumber diagnosing a leaky faucet – they wouldn’t just start replacing pipes without finding the source of the leak. Where are the slowdowns in your payment process? Are you losing customers because you don’t offer enough payment options? Are your processing fees draining your resources? Understanding your pain points will guide you to the right platform and help you focus on the features that truly matter. For example, if you’re seeing a lot of declined payments, prioritize platforms with intelligent retry logic and smart routing.

Identifying Opportunities: Where Orchestration Can Shine

Once you’ve identified your weaknesses, you can pinpoint exactly where payment orchestration can add the most value. Think of it like a conductor leading an orchestra – each musician plays a specific instrument, but the conductor brings them together to create beautiful music. Are you struggling to manage several different payment gateways? Is fraud keeping you up at night? Do you dream of offering more payment options to your customers? Identify the areas where a single platform can bring harmony to your payment operations. Also, think about your future. Choose a platform that can grow alongside your business, like a well-tailored suit that adjusts as you gain or lose weight.

This screenshot from Checkout.com shows a streamlined dashboard, much like the control panel of a spaceship, giving you a clear view of your payment universe. Key metrics and performance indicators are readily available, allowing for quick analysis and smart decisions. This real-time insight into payment flows is a major benefit of a unified platform.

Building Your Migration Plan: A Step-by-Step Approach

Migrating to a new payment system needs a careful plan. It’s like moving to a new house – you wouldn’t just throw everything in a truck and hope for the best. Start by defining your main objectives. What do you hope to accomplish with payment orchestration? Then, create a phased rollout plan to minimize disruption and allow for testing. This means each step of the migration can be carefully monitored and tweaked, reducing risk and ensuring a smooth transition.

Here’s a possible roadmap:

- Data Migration: Plan carefully how you will move your payment data to the new platform. This is like transferring precious family photos to a new album – you need to make sure everything arrives safely and nothing gets lost. Ensure data integrity and avoid any loss of information.

- Testing: Test everything thoroughly before going live, just like a pilot running through pre-flight checks. This helps prevent surprises and guarantees a smooth experience for your customers.

- Training: Train your team on the new platform. Think of it like giving your team the keys to a new car – they need to know how to drive it to get the most out of it. This empowers them to manage the system effectively.

- Compliance: Ensure compliance with any industry rules and regulations. Think of it like making sure your car has a valid registration and insurance – necessary for smooth operation. For example, ensure your platform is PCI DSS compliant.

Avoiding Common Pitfalls: Lessons From the Trenches

Many projects hit bumps in the road. Insufficient testing, messy data migration, and inadequate training are common culprits. By learning from others’ experiences, you can steer clear of these potholes and ensure a successful launch. However, even with the best planning, unexpected challenges can pop up. Be flexible and ready to adapt as needed.

Ongoing Optimization: Continuous Improvement

Implementing a payment orchestration platform isn’t a “set it and forget it” deal. It’s an ongoing journey of refinement and optimization. Imagine tending a garden – you need to regularly water, weed, and prune to keep it thriving. Continuously monitor performance, analyze data, and adjust your strategies. For example, review your routing rules and adjust them based on how each payment processor performs and its cost. This proactive approach keeps your payment system running smoothly and efficiently, making it a valuable asset for your business growth.

Advanced Optimization Strategies That Drive Measurable ROI

Once your payment orchestration platform is humming along, the magic happens when you start fine-tuning it. That’s the secret sauce successful businesses use to stay ahead. Think of it like a high-performance engine – regular maintenance and upgrades are key. Let’s explore some advanced strategies experts use to squeeze every drop of value from their payment orchestration platforms: real-time smart routing, cost-cutting techniques that can shave 15-30% off processing fees, and predictive analytics that nip problems in the bud.

Dynamic Routing: Adapting to Real-Time Conditions

Imagine your GPS app rerouting you around a traffic snarl. Dynamic routing for payments works much the same way. It constantly monitors the performance, cost, and success rates of your payment processors, automatically sending transactions through the most efficient pathway. This ensures speedy, cost-effective payments, even when things get bumpy. For instance, if one processor starts to lag, dynamic routing instantly redirects transactions to a faster alternative.

Cost Optimization: Saving Money on Every Transaction

Think of cost optimization as being a savvy shopper. It’s all about getting the best bang for your buck. Techniques like smart routing and negotiating better rates with processors can significantly reduce expenses. For example, by routing transactions through processors with lower fees for certain card types or geographic regions, you can unlock serious savings.

Predictive Analytics: Preventing Failures Before They Happen

Predictive analytics is like having a crystal ball for your payments. By examining past data and spotting trends, you can anticipate potential hiccups before they become headaches. This lets you proactively address issues like high decline rates or processor outages, creating a smoother payment experience for your customers.

A/B Testing: Refining Your Payment Flows

Ever try different versions of a recipe to find the perfect one? A/B testing lets you do that with your payment process. By experimenting with different checkout designs, payment options, and messaging, you can identify what works best. This optimizes conversion rates and minimizes abandoned carts. For more insights on recovering lost revenue, check out this article on Dunning Management: The Art of Recovering Lost Revenue.

Machine Learning: Smarter Decisions, Better Results

Machine learning takes data analysis to the next level, revealing hidden insights and streamlining payment processes. For instance, it can boost fraud detection accuracy, personalize the checkout experience, and even predict the most likely successful payment method for each customer. This intelligent automation boosts performance and creates a more efficient payment ecosystem.

Advanced Cascade Logic: Adapting to Market Dynamics

Just as markets shift, so should your payment strategy. Advanced cascade logic goes beyond basic failover systems, allowing you to set up sophisticated routing rules based on various factors. This guarantees efficient transaction processing, even in complex or unpredictable market conditions.

Understanding pricing structures and using your payment orchestration platform to optimize costs is crucial for maximizing ROI. Choosing pricing plans that match your transaction volume and business model keeps your payment processing cost-effective. By implementing these advanced optimization strategies, you can transform your payment orchestration platform from a simple tool into a powerful engine for revenue growth and business success.

Future-Proofing Your Payment Strategy: What’s Coming Next

The payments world is a bit like a fast-flowing river, constantly changing direction. Businesses that want to stay afloat need their payment orchestration platforms to adapt to these shifts. That means watching for emerging trends, integrating new tech, and staying one step ahead. Let’s dive into the currents shaping the future of payment orchestration.

AI-Powered Fraud Detection: Smarter Security

Imagine AI-powered fraud detection as a highly trained security guard for your payments. This guard is always learning, constantly getting better at spotting anything suspicious. These systems use machine learning to analyze mountains of data, picking up on subtle clues that a human might miss. This leads to better fraud prevention, fewer false alarms for legitimate customers, and a much smoother payment experience.

Blockchain Integration: Opportunities and Challenges

Blockchain technology presents a mixed bag for payment orchestration: exciting potential with some hurdles to overcome. Think of it as a shared, unchangeable ledger that logs every single transaction. This makes fraud and chargebacks way harder. While still early days, blockchain could transform payment processing by boosting security, transparency, and efficiency. But we still need to solve challenges like scaling, regulation, and wider acceptance.

Embedded Finance: Changing Customer Expectations

Embedded finance is like weaving financial services into the fabric of everyday life. It’s buying insurance when you get a new phone or seeing a loan offer within your accounting software. This trend is reshaping customer expectations, creating a demand for integrated and convenient payment options. Payment orchestration platforms need to get on board with this, offering flexible solutions that fit these new embedded finance models.

The broad range of services within Fintech shows just how quickly things are changing, highlighting the need for payment systems that can bend and adapt. This fusion of technology and finance requires payment orchestration platforms to stay agile and up-to-date. That’s how they can meet the changing needs of both businesses and customers.

Emerging Payment Methods: Staying Ahead of the Curve

New ways to pay are popping up all the time, from buy-now-pay-later to digital wallets and cryptocurrencies. To stay competitive and meet customer demand, payment orchestration platforms have to support these new methods. This requires smooth integration and the ability to quickly adapt to these payment trends. Handling these diverse payment methods efficiently can be a real game-changer, especially with the ongoing growth of global commerce.

Speaking of growth, the market for payment orchestration platforms is expected to be between USD 6.45 billion and USD 6.63 billion by 2030, growing at a rate of 17.3% to 20.87% each year. This shows just how much businesses need to simplify their payment processes and improve fraud detection. Find out more about this expanding market.

Building a Future-Proof Strategy

Creating a payment orchestration strategy that lasts requires careful planning and constant adjustment. It means choosing a platform that’s not only strong and dependable today but also adaptable enough to integrate new technologies and payment options as they appear. By embracing innovation and keeping up with industry trends, you can build a payment strategy that not only handles your current needs but also sets your business up for success in the constantly changing world of payments.

Ready to improve your payment recovery and reduce customer loss? Explore Stunning, a payment recovery platform built to work seamlessly with Stripe and Subbly, automating failed payment management and maximizing your revenue.