Stop Losing Money: Mastering the Art of Failed Payment Emails

Recovering lost revenue from failed payments is crucial for any subscription-based business. This listicle reveals six common failed payment email template mistakes that could be draining your profits and provides actionable strategies to transform your dunning process into a revenue-generating engine. We’ll dissect examples, highlighting specific tactics and the “why” behind their effectiveness, so you can immediately apply these insights to your own business.

Why Your Failed Payment Emails Matter

Effective failed payment email templates aren’t just about recovering money; they’re about retaining customers. A poorly crafted email can alienate loyal subscribers, while a well-designed one can reinforce your brand’s value and encourage continued engagement. To further streamline the payment recovery process, consider implementing a robust system for handling failed payments, starting with efficient strategies for payment gateway integration. This resource from Iconcept ltd can provide valuable guidance in this area. This listicle analyzes critical components of successful dunning emails, helping you avoid common pitfalls and maximize your recovery rate. We’ll explore how to:

- Craft clear, concise, and actionable email copy

- Balance urgency with empathy to maintain customer relationships

- Optimize your email timing and frequency for maximum impact

- Ensure mobile-friendliness for optimal viewing across devices

This article will specifically analyze the following examples of ineffective failed payment email templates:

- The Overly Aggressive Dunning Email

- The Vague and Unhelpful Template

- The Over-Complicated Technical Jargon Template

- The Generic One-Size-Fits-All Template

- The Poor Timing and Frequency Template System

- The Mobile-Unfriendly Template

Ready to transform your failed payment emails from a source of frustration into a revenue-generating powerhouse? Let’s dive in.

1. The Overly Aggressive Dunning Email

The overly aggressive dunning email is a failed payment email template that relies on fear tactics and intimidation to prompt payment. Instead of offering helpful solutions, it bombards the customer with harsh language, threats of immediate account suspension, and often excessive use of all-caps and exclamation points. This approach, while seemingly urgent, ultimately alienates customers and drives up churn rates. It damages the customer relationship and portrays the business in a negative light.

Small subscription services, utility companies, and SaaS platforms are sometimes guilty of employing these tactics. Imagine receiving an email threatening immediate service termination just hours after a failed payment – hardly a positive customer experience. Such aggressive strategies often backfire, creating resentment and pushing customers away rather than encouraging them to rectify the payment issue. Learn more about handling dunning emails effectively.

Examples of Overly Aggressive Dunning Emails

- Subscription Box Service: “YOUR ACCOUNT IS DELINQUENT! PAY NOW OR LOSE ACCESS IMMEDIATELY!!”

- Utility Company: “FINAL NOTICE! FAILURE TO PAY WITHIN 24 HOURS WILL RESULT IN LEGAL ACTION!”

- SaaS Platform: “SERVICE TERMINATION WARNING! YOUR ACCOUNT WILL BE DELETED IF PAYMENT IS NOT RECEIVED.”

These examples highlight the harsh tone and immediate consequences threatened in overly aggressive dunning emails. This approach assumes malicious intent on the customer’s part, neglecting potential reasons for failed payments like expired cards or technical glitches.

Tips for Improvement

Instead of resorting to intimidation, focus on building a positive customer experience, even during the dunning process. Crafting effective failed payment emails requires understanding general email marketing best practices, such as those outlined in this article about : B2B Email Marketing Best Practices. Here are some key strategies:

- Replace threats with guidance: Offer helpful solutions and clear steps for updating payment information.

- Offer options: Provide multiple payment methods and make it easy for customers to choose the most convenient one.

- Emphasize customer support: Include clear contact information for your customer service team and encourage customers to reach out for assistance.

- Professional and empathetic tone: Use a calm and respectful tone that acknowledges potential reasons for failed payments. This builds trust and encourages cooperation.

- Clear resolution steps: Outline the steps customers need to take to resolve the issue, making the process as simple and straightforward as possible.

When Not to Use This Approach

This aggressive approach is never recommended. It damages your brand reputation, increases customer churn, and ultimately hinders your revenue growth. A customer-centric approach focused on problem-solving and helpful communication is always the best strategy for failed payment email templates. By focusing on a positive customer journey, you can recover payments more effectively and build stronger, longer-lasting customer relationships. This benefits both your business and your customers in the long run, fostering loyalty and reducing the need for aggressive tactics.

2. The Vague and Unhelpful Template

The vague and unhelpful failed payment email template is a common culprit in customer frustration and delayed payments. This type of email offers minimal information about the payment failure, leaving customers confused about what went wrong and how to fix it. It often lacks specific error details, clear resolution steps, or alternative payment methods, creating a poor customer experience and hindering payment recovery efforts. Instead of guiding the customer towards a solution, it leaves them in the dark, increasing the likelihood of churn.

Small businesses, subscription services, and e-commerce platforms sometimes fall into the trap of sending generic “payment failed” notices. Imagine receiving an email simply stating “Your payment didn’t go through” without any further explanation. This leaves the customer guessing about the cause of the failure and the necessary steps to rectify it. This lack of clarity can lead to delayed payments, increased support inquiries, and ultimately, customer churn.

Examples of Vague and Unhelpful Emails

- E-commerce Site: “Payment failed. Please try again.”

- Subscription Service: “There was a billing issue with your account.”

- Mobile App: “Error Code: 402. Payment declined.”

These examples demonstrate the lack of specificity that characterizes vague failed payment emails. Without clear guidance, customers are left to their own devices to figure out the problem, resulting in a frustrating experience.

Tips for Improvement

Transforming a vague email into a helpful one requires providing specific information and clear guidance. By following these strategies, you can significantly improve your payment recovery rate and enhance the customer experience:

- Include the specific reason for payment failure: Instead of a generic “payment failed” message, specify the reason, such as “Insufficient funds,” “Expired card,” or “Incorrect card details.”

- Provide step-by-step resolution instructions: Guide customers through the process of updating their payment information with clear and concise instructions. Include direct links to payment update pages within your platform.

- Offer multiple contact methods for support: Make it easy for customers to reach out for assistance by providing phone numbers, email addresses, and live chat options.

- Add an FAQ section for common issues: Anticipate common customer questions and address them proactively within the email or by linking to a comprehensive FAQ page.

When Not to Use This Approach

The vague approach should never be used. It creates unnecessary friction in the customer journey and hinders your ability to recover failed payments efficiently. While seemingly simple to implement, this type of email ultimately creates more work for your support team and increases customer churn. A proactive and informative approach is always the preferred strategy for failed payment communication. By providing clear information and guidance, you empower your customers to resolve the issue quickly and efficiently, fostering a positive customer experience and maximizing payment recovery.

3. The Over-Complicated Technical Jargon Template

The over-complicated technical jargon template is a failed payment email template that overwhelms customers with technical payment processing terminology, error codes, and complex explanations. Most users cannot understand this type of information. It often includes banking terminology and system-specific language that creates confusion rather than clarity. This approach, while seemingly informative from a technical standpoint, can alienate customers and prevent them from taking action to resolve the payment issue.

Payment processors, B2B platforms, and financial services are sometimes guilty of employing these tactics. Imagine receiving an email filled with phrases like “PCI DSS compliance error” or “AVS mismatch” after a failed payment – hardly a user-friendly experience. Such technical language assumes a high level of technical expertise from the customer, neglecting the fact that most users are not familiar with these terms.

Examples of Over-Complicated Technical Jargon Emails

- Payment Processor: “Error Code: 402 – Payment Processor Declined: Insufficient Funds (Code: AVS Mismatch).”

- B2B Platform: “System Error: Transaction ID [1234567890] failed due to a null pointer exception during the authorization process.”

- Financial Services: “Your ACH transfer was rejected due to an invalid routing number. Please verify your banking details and resubmit.”

These examples highlight the complex and technical language used in these emails. This approach often overlooks the customer’s perspective and creates a barrier to resolving the payment issue quickly.

Tips for Improvement

Instead of using technical jargon, focus on clear, concise, and customer-friendly language. Here are some key strategies:

- Translate technical errors into plain language: Replace error codes and technical terms with simple explanations that anyone can understand. For example, instead of “AVS Mismatch,” say “The billing address you entered doesn’t match the address on file with your card issuer.”

- Use simple, actionable language: Tell customers exactly what they need to do to resolve the issue in plain, easy-to-understand terms.

- Provide technical details in expandable sections: If you need to include technical details for troubleshooting purposes, place them in a collapsible section or a separate link so that they don’t overwhelm the average user.

- Create customer-friendly error explanations: Develop a library of common error messages and their corresponding explanations in plain English.

- Test templates with non-technical users: Before sending out your emails, have non-technical users review them to ensure they are easy to understand and actionable.

When Not to Use This Approach

Avoid this overly technical approach in almost all cases, especially when communicating directly with customers. It creates unnecessary confusion and frustration. A customer-centric approach focused on clear communication and simple solutions is always the best strategy for failed payment email templates.

By simplifying your language and focusing on the customer experience, you can increase the likelihood of successful payment recovery and build stronger customer relationships. This approach benefits both your business and your customers, creating a smoother payment process and fostering customer loyalty. Providing a clear and concise explanation empowers customers to take action and resolve the payment issue efficiently.

4. The Generic One-Size-Fits-All Template

The generic one-size-fits-all failed payment email template is a common, yet ineffective, approach. It uses the same email for all payment failures, regardless of the reason. Whether a card expired, funds were insufficient, or a technical error occurred, the customer receives the identical, impersonal message. This lack of personalization and context creates a poor user experience and significantly reduces resolution rates. It’s akin to using a single wrench for every repair job – sometimes it might work, but more often than not, it leads to frustration and further damage.

Small businesses and startups often fall into this trap, using a single template for all payment-related issues. Large enterprises, burdened with complex systems, can also struggle with implementing nuanced communication strategies. Imagine receiving the same email for a declined payment due to insufficient funds as you would for an expired card – the generic nature feels dismissive and unhelpful. This approach fails to acknowledge the specific customer’s situation and provides little guidance for rectifying the unique problem.

Examples of Generic One-Size-Fits-All Emails

- SaaS Company: Using the same template for both expired cards and declined payments.

- E-commerce Site: Not differentiating between payment methods (credit card, PayPal, etc.) in their communication.

- Subscription Service: Ignoring customer payment history and sending generic “payment failed” emails regardless of past successful transactions.

These examples showcase the lack of segmentation and personalized communication that characterizes this flawed approach. Each scenario requires a tailored response to address the specific issue and guide the customer towards a solution.

Tips for Improvement

Moving away from generic templates requires a more strategic and customer-centric approach to failed payment emails. Think of each email as an opportunity to guide the customer towards a successful payment and strengthen the customer relationship. Consider these crucial strategies:

- Create specific templates for different failure types: Tailor your messaging to address the unique reason for the failed payment (expired card, insufficient funds, etc.).

- Personalize based on customer segment and history: A loyal, long-term customer should receive a different communication than a new subscriber with their first failed payment.

- Use dynamic content based on payment method: Offer specific instructions based on the payment method used (e.g., updating card details vs. linking a new PayPal account).

- Implement triggered workflows for different scenarios: Automate email sequences based on the specific reason for failure and the customer’s behavior.

- A/B test different approaches for various segments: Continuously optimize your email templates based on data and customer feedback.

When Not to Use This Approach

The one-size-fits-all approach is never the optimal strategy for failed payment email templates. It indicates a lack of customer focus and hinders your ability to effectively recover lost revenue. The modern customer expects personalized communication that addresses their specific needs and provides helpful solutions. A tailored approach demonstrates respect for their time and increases the likelihood of a successful payment recovery. By investing in segmented and personalized communication, businesses can significantly improve their payment recovery rates and foster stronger customer relationships, ultimately driving revenue growth.

5. The Poor Timing and Frequency Template System

The Poor Timing and Frequency Template System represents a common pitfall in failed payment email templates. It centers around sending payment failure notifications at inopportune times or with poorly managed frequency. This can manifest as bombarding customers with multiple emails within hours, waiting too long to notify them of the issue, or completely disregarding time zones. This system ultimately lacks strategic timing and a proper escalation plan, hindering recovery efforts and frustrating customers.

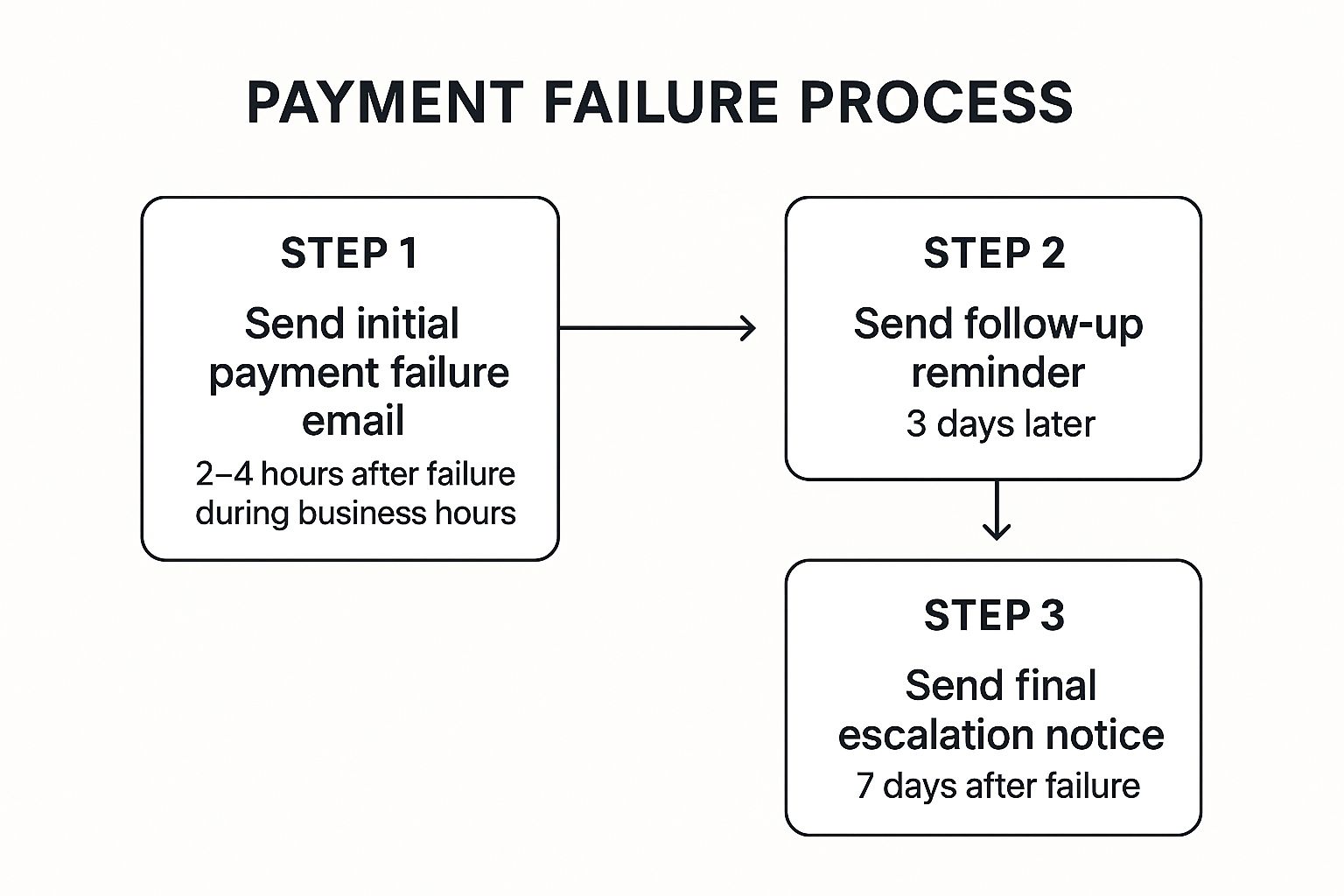

The infographic above illustrates a streamlined three-step process for managing failed payment notifications. It emphasizes a balanced approach: providing timely reminders without overwhelming customers. This clear, structured system prioritizes efficient communication and maximizes the chances of successful payment recovery. Learn more about recovering failed payments.

Examples of Poor Timing and Frequency

- Subscription Services: Sending multiple emails within 24 hours of a failed payment can overwhelm customers and lead to them unsubscribing or marking emails as spam.

- International Companies: Failing to account for customer time zones can result in emails arriving at inconvenient times, such as the middle of the night, reducing their effectiveness and potentially annoying customers.

- Services Sending Weekend Notices: Sending failure notices during weekends, when banks are often closed, prevents customers from immediately rectifying the issue, adding to their frustration.

These examples illustrate the negative impact of poor timing and frequency on customer experience and payment recovery efforts.

Tips for Improvement

Optimizing the timing and frequency of your failed payment emails requires a strategic approach. Consider these key strategies:

- Timezone-Aware Sending: Implement systems that automatically adjust sending times based on the customer’s time zone. This ensures emails are received during business hours, increasing the likelihood of prompt action.

- Escalation Schedules: Create a tiered escalation schedule for sending reminders (e.g., 24 hours, 3 days, 7 days). This provides ample opportunity for customers to address the issue without overwhelming them with excessive notifications.

- Avoid Off-Hours/Holidays: Refrain from sending emails during off-hours or holidays. Respecting customers’ personal time demonstrates professionalism and prevents unnecessary frustration.

- Limit Frequency: Carefully manage the frequency of your emails to prevent email fatigue. Find a balance between providing timely reminders and avoiding excessive contact.

- Progressive Messaging: Use progressively urgent messaging as time elapses. Initial emails can be gentle reminders, while later ones can emphasize the potential consequences of non-payment.

When to Use This Approach

This strategic approach to timing and frequency is essential for all businesses handling recurring payments. Effective implementation is crucial for maximizing payment recovery rates, minimizing customer churn, and maintaining a positive brand image. A well-planned system benefits both your business and your customers, ensuring smooth transactions and a positive customer experience.

6. The Mobile-Unfriendly Template

The mobile-unfriendly failed payment email template is a critical oversight in today’s mobile-first world. This template fails to consider the vast majority of users who open emails on their smartphones or tablets. It’s characterized by poor responsive design, tiny text, broken layouts on mobile devices, and buttons that are difficult to tap. With over 60% of emails opened on mobile devices, this creates significant barriers to payment resolution and increases customer frustration.

Small businesses, e-commerce platforms with desktop-only email designs, B2B services assuming desktop email reading, and even payment processors with tiny “Update Payment” buttons are often guilty of using mobile-unfriendly templates. Imagine trying to update your payment information on a small screen with a button the size of your fingernail – a recipe for frustration and lost revenue. This oversight not only hinders payment recovery but also damages the customer experience.

Examples of Mobile-Unfriendly Emails

- E-commerce Platform: A desktop-designed email shrinks to an unreadable size on mobile, requiring constant zooming and scrolling.

- B2B Service: Long paragraphs of text become overwhelming on a small screen, discouraging users from taking action.

- Payment Processor: A tiny “Update Payment” button is nearly impossible to tap accurately on a mobile device, leading to frustration.

These examples demonstrate the common pitfalls of ignoring mobile optimization in failed payment emails. This can lead to decreased conversion rates and increased customer churn.

Tips for Improvement

Optimizing your failed payment email templates for mobile is crucial for maximizing payment recovery and enhancing the customer experience. Consider these key strategies:

- Responsive Design: Utilize responsive email design frameworks or templates that automatically adjust to different screen sizes. This ensures a seamless experience across all devices.

- Button Size: Make call-to-action buttons, like “Update Payment,” at least 44px tall for easy tapping on touchscreens. This improves usability and encourages action.

- Font Size: Use larger font sizes (minimum 14px) to ensure readability on smaller screens. This prevents eye strain and improves accessibility.

- Mobile Testing: Test your emails on various mobile devices and operating systems to identify and fix any display issues. This ensures a consistent experience for all users.

- Single-Column Layouts: Prioritize single-column layouts for mobile, making it easier for users to scroll and read the content without horizontal scrolling.

When Not to Use This Approach

A mobile-unfriendly approach should never be used. In today’s mobile-dominated world, neglecting mobile optimization is a significant missed opportunity. It creates a negative customer experience, reduces conversion rates, and ultimately hinders your revenue growth. You can encounter layout issues when using payment processors with existing email templates, and you might want to learn more about how Stripe elements fields can overlap on smaller screens. By prioritizing mobile responsiveness in your failed payment emails, you can significantly improve payment recovery rates and build stronger customer relationships. This approach benefits both your business and your customers, ensuring a smooth and efficient payment process regardless of the device used.

Failed Payment Email Template Comparison

| Template Type | 🔄 Implementation Complexity | ⚡ Resource Requirements | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| The Overly Aggressive Dunning Email | Low – easy to send but harsh tone | Minimal design and copywriting | High immediate attention but high churn | Small subscriptions needing urgent action | Urgency is clearly conveyed |

| The Vague and Unhelpful Template | Very low – simple and generic | Very low | Confused customers, delayed payments | Quick basic notification without customization | Fast to create and deploy |

| The Over-Complicated Technical Jargon Template | High – requires technical knowledge | High due to detailed content | Customer confusion, support ticket rise | B2B or tech-savvy audiences needing detail | Appears thorough and comprehensive |

| The Generic One-Size-Fits-All Template | Low – simple uniform messaging | Low | Poor user experience, low resolution rate | Organizations with limited segmentation ability | Consistent messaging, low development cost |

| The Poor Timing and Frequency Template System | Medium – needs scheduling logic | Moderate – automation tools | Annoyed customers, unsubscribes spam | Any service with automated emails | Ensures all notifications are sent |

| The Mobile-Unfriendly Template | Medium – requires responsive design | Moderate – design and testing | High abandonment on mobile, poor UX | Desktop-focused services, legacy designs | Faster desktop deployment |

Transforming Failed Payments into Opportunities with Stunning

Throughout this article, we’ve dissected six common pitfalls in failed payment email templates: aggressive dunning, vague language, technical jargon, generic messaging, poor timing, and mobile incompatibility. Each of these mistakes can negatively impact your customer relationships and ultimately, your bottom line. By understanding these common errors, you’re now equipped to craft compelling emails that recover revenue and retain subscribers.

Key Takeaways for Effective Email Templates

Let’s recap the key takeaways for creating high-performing failed payment email templates:

- Empathy is Key: Approach failed payments with understanding, not aggression. Frame the email as helpful, not accusatory.

- Clarity and Conciseness: Use clear, concise language, avoiding technical jargon. Explain the issue and solution simply.

- Personalization Matters: Tailor your emails to the individual subscriber. Consider their purchase history and subscription level.

- Strategic Timing and Frequency: Implement a well-timed sequence of emails, giving customers ample opportunity to rectify the issue without overwhelming them.

- Mobile Optimization is Crucial: In today’s mobile-first world, ensuring your emails are easily readable on any device is paramount. To avoid alienating your mobile users, ensure your failed payment email templates are optimized for mobile devices. Learn more about creating a mobile-friendly website.

Optimizing for Conversions and Customer Retention

Mastering the art of the failed payment email is more than just recovering lost revenue; it’s about building stronger customer relationships. A positive dunning experience can turn a potentially negative interaction into an opportunity to reinforce your brand’s commitment to customer service. This proactive approach can significantly reduce churn and foster long-term customer loyalty.

Streamlining Your Dunning Process with Automation

Manually managing failed payments can be a time-consuming and inefficient process. As your business scales, automation becomes essential for maximizing recovery rates and minimizing manual effort.

Stunning: Your Solution for Seamless Payment Recovery

Are you ready to transform your failed payments from a source of frustration into a revenue-generating opportunity? Stunning offers a comprehensive solution for automating your dunning process and optimizing your failed payment email templates. Stunning integrates with platforms like Stripe and Subbly, enabling you to monitor transactions, retry payments, and deploy personalized dunning campaigns seamlessly. Reclaim lost revenue and improve customer retention with Stunning. Start your free trial today and experience the difference a streamlined, automated approach can make to your bottom line.

Article created using Outrank